Games Industry Finance Cheat Sheet: Winter 2026 edition, 19/02/2026

Xbox floundering, EA firing, and Roblox on the up

We summarise the major industry financial results for your reading ease

ByteDance preps sale of Moonton to Saudi Arabia’s Savvy Games for $6bn

Styx: Blades of Greed sneaks its way to the top of a quiet week of releases

Hello VGIM-ers,

Before we go into this week’s newsletter, I have big news about the ol’ book.

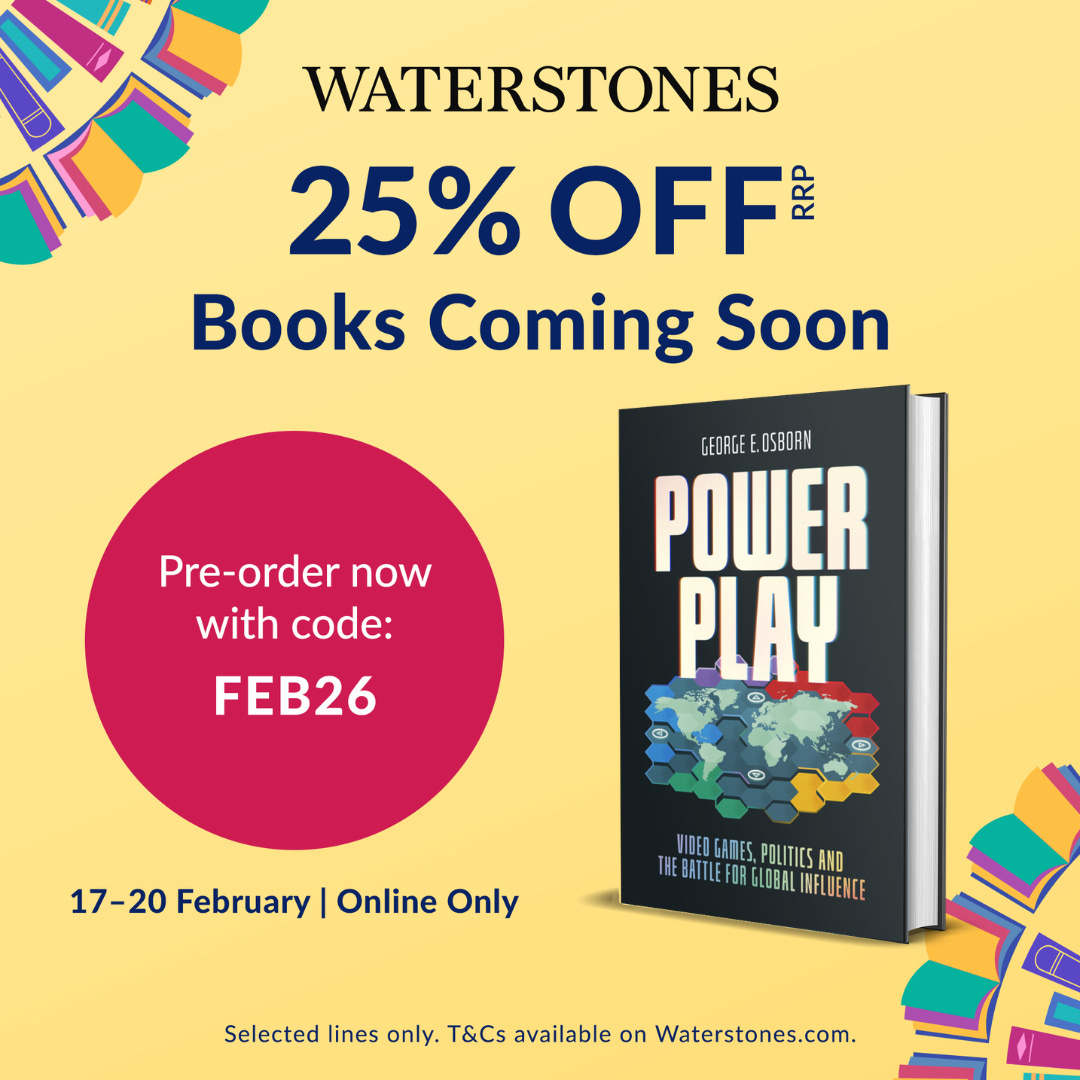

Power Play has been picked by Waterstones to feature in a special pre-order sale, and you can bag it for a nice discount right this second.

You can pick up a copy of the book for just £16.50, a 25% saving, by heading to the Waterstones website and using the code FEB26 at checkout.

And best of all, Waterstones has international delivery options. That means anyone in the world can make the most of this lovely little deal.

But you’re going to have to be quick. The offer ends tomorrow evening UK time, so you’ll need to move fast to get your discounted copy.

Want to grab your copy of the book and save yourself some all-important cash?

Hit this link and get pre-ordering now.

The big read - Games Industry Finance Cheat Sheet: Winter 2026

Cheat sheet readers always prosper: It’s that time of year again. As per VGIM tradition, I’m rolling out the latest edition of our legendary quarterly games industry finance cheat sheets to give you the lowdown on the biznezz of digital play.

Outlining the rules: For those of you who’ve not seen one of these before, the cheat sheet is simple enough to explain. I dig through the financial results of publicly traded game companies. I write up a quick commentary on the performance of some notable picks, highlighting ups and downs. I then round the sheet off with a pithy/glib summary of the state of play, which you can steal to regurgitate in business meetings at your leisure.

Getting on with it: So without further ado, let’s get into the latest financial results shaping the game business.

PlayStation: Hardware times

Ghost at the sales party: Sony’s latest financial results showed that first-party hits like Ghost of Yōtei have not given PlayStation enough uplift to overcome struggles within its hardware division.

Tricky times: The company reported that sales in its Game and Network services segment decreased from $10.9bn (¥1.68tn) in Q3 2024 to $10.5bn (¥1.61tn) in Q3 2025 due to a drop in hardware sales. And while its overall operating income increased because of a bump in sales of network services like PlayStation Plus and first-party game software titles, hardware losses acted as a drag on that growth too.

Long-term problems?: PlayStation has almost certainly suffered as a result of Grand Theft Auto VI being delayed into late 2026, removing a major reason for players to upgrade to a new device last year. But with rapidly rising RAM costs likely to lead to cost increases of all consoles (see the news in brief section), expect to see harder times for Sony’s hardware business in the years to come.

Xbox: The struggles continue

Problem child: Microsoft’s revenue grew 17% year-on-year to $81.3bn in Q2 of its 2026 financial year, with operating income also up by 21% to $38.3bn in the same reporting period. But the company’s strong performance masked Xbox’s ongoing struggles, raising genuine questions about the future of its games business.

Downward spiral: Xbox content and services revenue declined by 5% year-on-year due to the underperformance of first-party releases (almost certainly Call of Duty: Black Ops 7). Hardware revenues, meanwhile, declined by an alarming 32%, with the launch of the Xbox-branded ROG Ally in October 2024 doing little to arrest the slide.

Deck chairs on the Titanic: The ongoing poor performance of the Xbox brand since Microsoft forked out $69bn to acquire Activision Blizzard will likely be a source of concern for the company’s leadership. And while rumours abound that the next Xbox console will bring PC rivals like Steam and Epic onto the device to strengthen its offer to players, don’t expect strategic shifts like this to address serious structural problems within the company’s business.

Nintendo: Great expectations, decent performance

Make it add up: Nintendo saw its share price slip by 11% following its latest financial results, after it posted merely very good results instead of outstanding ones for the nine months ending December 2025.

Cha-ching: The company reported net sales hit $12.4bn (¥1.9 trillion) over the period, an increase of 99.3% year-on-year. Operating profit grew by 21.3% and ordinary profit leapt by 39.4% compared to the last comparable period. Turns out that launching a brand new console following a very quiet year is very good for business.

A steady Switch 2 a new console: However, markets were less impressed with the bumper growth. Despite the Switch 2 outselling forecasts to ship 17.37m units in the first nine months of the year, the lack of first-party big hitters outside of the 14m unit-selling Mario Kart World has spooked investors.

No first party: With Donkey Kong: Bananza selling a respectable 4.25m units and Metroid Prime 4 selling poorly enough to be omitted from the quarterly highlights, Nintendo needs to show that its forthcoming release line-up has a dazzling hit on the horizon. Otherwise, investors will remain sceptical about the Switch 2 maintaining its momentum - especially with those dreaded RAM price increases hitting the company too.

Electronic Arts: Dominating with Battlefield

It’s in the game: Soon-to-be-PIFed Electronic Arts had a memorable third fiscal quarter. Net bookings increased 38% year-on-year to $3bn, and net revenue reached $1.9bn as the company’s portfolio of releases performed strongly.

Shooting down its rivals: The jewel in the company’s crown was Battlefield 6. The game shot down rivals such as Call of Duty: Black Ops 7 to become the best-selling shooter of 2025. It also set new records for engagement with the franchise, according to EA’s corporate birt-speak.

Tasty loot boxy goodness: But the company also saw strong performance in some of its evergreen service games. EA Sports FC recorded high single-digit year-on-year growth, as Ultimate Team continued to prove devilishly moreish. Apex Legends, meanwhile, saw net bookings up by double digits compared to this time last year.

Nearing the end: The company remains on course for its acquisition by the PIF to be completed by 2027. So we’ll have to enjoy its final round of financial results while we still have the chance.

Ubisoft: Creative Houses Accounting

Overextended metaphor: Despite wobbling harder than a jelly in an earthquake last year, Ubisoft emerged from Q3 2025-2026 with a set of financial results that’ll please hard-hearted market watchers.

Better than expected: The company’s Q3 net bookings grew to $399.5m (€338m), an increase of 12% year-on-year, overperforming Ubisoft’s expectations. The company reported that the result was driven by partnerships and the Assassin’s Creed franchise overperforming. It also said that back-catalogue sales were up 11% compared to this quarter last year, with Avatar and The Division doing numbers.

Road to recovery: The results are good news for the company. The company’s market cap dropped below the billion-dollar mark to $680bn (€575m), following the announcement that it was reorganising into five creative houses. But with the company sucking up some seriously unpopular headcount reductions and demonstrating that it has plenty of potential to make bank, it should be well-placed to recover in the years ahead.

Roblox: On the path, or stuck on the treadmill, to profitability?

Growing pains: Roblox’s results for Q4 2025 once again showed a company chasing scale, while trying to keep its losses in check.

Mixed picture: The company reported 144m daily active users, an increase of 69% year-on-year, and 35bn hours of engagement, up 88% from Q4 2024. But while revenue grew by 43% to $1.4bn and bookings increased by 63% to $2.2bn year-on-year, the company recorded a $318m loss for the quarter - an increase from this time last year.

Strategic priorities: However, the company described 2025 as a “banner year” for the company after revenue grew 36% year-over-year to $4.9bn. And as long as it continues to demonstrate a hefty user count and revenue growth, it will be well placed to continue its steady swallowing up of the traditional games industry in the years ahead.

Best of the rest

Who needs Grand Theft Auto VI? Not Take-Two, apparently. The company’s net bookings grew 28% year-on-year to $1.76bn in the third quarter of its 2026 fiscal year, with titles such as Toon Blast, Empires and Puzzles, NBA 2K26, and a little-known game called *checks notes* Grand Theft Auto Online continuing to keep the company performing above its guidance to the market.

Unity acted as a handy reminder that telling the right corporate story is essential to long-term commercial success. The game engine maker reported increased revenue in its create solutions ($165m vs $152m last year) and grow solutions ($338m vs $305m in 2024). But misaligned market expectations and the spectre of Google’s Project Genie generative AI engine saw the company’s stock value slump, with few investors taking comfort in Chief Exec Matthew Bromberg’s efforts to spin AI disruption in Unity’s favour.

Embracer Group reported that profitability and sales were comfortably down year-on-year in its latest results, but described the results as a ‘clear improvement’ on the year before. The reason for the confusion is likely that i) it divested a hefty chunk of mobile revenue by selling off Easybrain to MiniClip and ii) Kingdom Come: Deliverance II did numbers.

Tencent’s results aren’t due for a while. But rival NetEase has reported that revenue has grown 6.9% in 2025 to hit $16.1bn (RMB 112.6bn). A full 97% of the company’s revenue came from online games, with Fantasy Westward Journey Online and Marvel Rivals two of the company’s standout stars.

And Capcom continues to be the star performing business in the video game world. Net sales jumped 29.8% year-on-year to hit $749m (¥115.3bn), and operating income leapt by 75.1% to $353m (¥54.3bn), despite the company’s long-term run of financial hits. The announcement of Resident Evil Requiem, steady sales of Street Fighter 6, and the ongoing strength of both Devil May Cry and Monster Hunter franchises kept the good vibes going for the Japanese giant.

The Bluffer’s Guide to the Winter 2026 financial results

Do say: The games industry is being buffeted by headwinds from over-investment into the AI economy, leaving companies with strong software portfolios and less direct exposure to rising hardware costs better placed to weather the storm.

Don’t say: “…ladies and gentlemen, we’ll start the bidding for this stick of RAM at one million dollars. Can I see a million dollars in the room, please?”

News in brief

A Moonton of money: ByteDance is reportedly close to reaching a deal with Savvy Games to sell Moonton, the business known for Mobile Legends: Bang Bang, for $6bn. Bloomberg reports that terms have been broadly agreed and that the deal could be announced this quarter. The deal will further strengthen Savvy’s position in mobile games, while bringing an increasingly large esports-friendly title into its competitive gaming portfolio.

RAM raided: Video games hardware manufacturers are beginning to creak under the pressure of RAM shortages caused by the more-than-a-bit-stupid AI hype bubble. Valve has confirmed that its Steam Deck OLED “may be out-of-stock intermittently” due to shortages, Nintendo is reportedly considering a price increase of its Switch 2 to deal with rising costs, and Sony is apparently considering delaying the release of its next console by a year to try to wait out the challenges. Re-read Eurogamer’s Bertie Purchese’s piece about the causes of the shortage here to understand exactly what’s going on and why this could result in serious pain for the consumer games business.

North of the border: Ukie spin-off Interactive Entertainment Scotland has released its manifesto ahead of this year’s Scottish Parliament elections. The 16-page document calls for a review of existing policy support for the country’s games business, developing new sources of funding akin to schemes seen in Wales and Northern Ireland, and enhanced support for schemes supporting talent across the country. The manifesto launch follows the recent unveiling of Scotland’s Games Action Plan, a point which was raised directly with Ukie in response to the announcement.

Steam’s moderation problems: The Guardian’s Geoffrey Bunting has written a piece about Steam’s lackadaisical moderation policies and the impact it has on creators and players alike. His article outlines how Steam’s failure to effectively moderate its social media-like functions has turned it into a breeding ground for hate and harassment, particularly affecting LGBTQ+ content creators whose concerns go unheard by the company. It’s a prime target for online safety regulators, I’d say.

Discord in the ranks: Finally, and speaking of online safety rules, BBC News has spoken to content creators and academics who have expressed concerns over Discord’s decision to roll out age verification for its global user base. What the piece does mention are the reasonable concerns amongst individuals about handing over sensitive identification data to technology companies. What it doesn’t mention is that Discord’s move is a direct result of online safety rules that legally mandate and culturally normalise the use of the technology.

Don’t forget: you can order Power Play with a 25% discount from Waterstones this week. Key in the code FEB26 at checkout to pre-order your copy of the book for just £16.50.

Grab the deal at the Waterstones website before the end of Friday 20th February by clicking here.

Moving on

The big move that took place while I was on jury duty was David Helgason stepping down from Unity’s board alongside Tomer Bar-Zee. Bernard Kim is in as a replacement…Jay Sullivan was recently appointed as CEO at Fandom…Emily Pestell has a new title of Senior Brand Communications Manager at King…Annabelle Shoel has been promoted to Campaign Manager at YRS TRULY…And Rebekah Nicodemus has been announced as the head honcho of Bastion America…

Jobs ahoy

Sega Europe is recruiting a Head of Social and Content…Make-A-Wish UK is hiring a Gaming and Creator Partnerships Manager…Rockstar Games is rather ominously looking for a Principal Investigations Analyst…2K Games is hunting down a Senior Director of Community and Digital Content Strategy, Core Games in Los Angeles…And Nvidia is seeking a Hackathon Program Manager - APAC to help it out in Singapore…

Events and conferences

Guildford Games Festival, Guildford - 20th February

devcom leadership summit, Lisbon - 24th-26th February

Game Developer Conference, San Francisco - 9th-13th March

PAX East, Boston - 26th-29th March

Games for Change Summit, London - 15th April

Games of the week

Styx: Blades of Greed - Latest entry in the fantasy-based stealth series promises greater freedom than ever to sneak and heist however you like.

Avowed - Obsidian’s perfectly reasonable role-playing game with a perfectly reasonable price tag rocks up on PlayStation 5.

Star Trek: Voyager - Across the Unknown - Play a story-driven strategy game set in the Star Trek universe that gives off vibes of building your main base in XCOM.

Before you go…

Roses are red. Violets are blue. Video game romances rely too much on lore dumps. Do you agree too?

Then you'd better read Josh Broadwell’s piece for Polygon, which ponders why so many interactive romances are less Casablanca and more listening to someone bore on forever on a first date without bothering to ask you a question.

Keep up with VGIM: | Linkedin | Bluesky | Email | Power Play |